Millenials are the largest generation in history and they are about to move into their prime spending years. Smart marketers look at what and how millenials buy consumer goods. The purchasing power of millenials is $170 billion per year, and we need to know what the heck they are buying so we can sell it to them! If you are not in touch with what millenials are buying, you are leaving money on the table.

I've had a secret weapon and millenial informant for the last few years - and now you can benefit from her knowledge, too. I am excited to announce that my daughter, Melanie Wells, is now offering eBay tutoring and consulting services to help other sellers grow their eBay businesses. Not only can she help you get in touch with the millenial consumer, but she can help you learn to be a better eBay seller.

Many of you have been following my daughter's eBay journey on my blog and my Facebook Group. Melanie started selling in 2012, at the age of 18. She has worked hard building her store - she has sold over 2,000 items in her eBay career, while working other full and part time jobs.

Training closely beside me every day for the last 3 1/2 years, eBay is a way of life for Melanie. If there was a Bachelor's Degree in eBay, she would have one. Melanie was industrious enough to work her eBay business and save enough money to pay cash for a car earlier this year. (Read her story here.) She has been a mentor and leader in the eBay community by helping other sellers and participating regularly in the Money Making Mondays threads on my Facebook Group. Here are some of her posts about her sales:

She is a smart cookie. As a 21 year old, she is in touch with what Gen Y / Millenials are up to and has taught me how to cash in on that market. She pays attention to what is posted on social media, what her friends are into, and what is new on the scene. She has helped me make a lot of money by mentioning brands that sell well, decorating trends, crafts, or repurposing ideas that I was clueless about. She also knows how to use technology and social media for sourcing inventory, such as her recent score on a Facebook Group that she flipped on eBay.

Melanie has also helped several local sellers with their eBay business by teaching them what to buy for resale, teaching them how to list, hhelping them learn how to ship, and serving in a listing and shipping assistant role. She was a big help to our dear friend Catherine - who will live in infamy for the funniest eBay fail ever, but also has an amazing boutique in her basement.

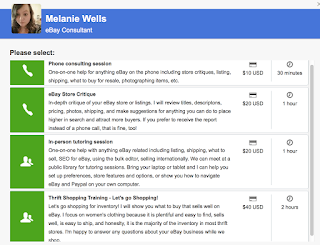

How can Melanie help you? She offers the following services:

Feel free to contact Melanie with any questions about her services. She is a delight to work with and you won't be disappointed!